"Those who pass all four health markers — Body Mass Index, blood pressure, fasting blood glucose and cholesterol — and are currently insured under NTUC Income’s IncomeShield or Enhanced IncomeShield will receive a S$50 CapitaMall shopping voucher each year that they take the test. Singaporeans who are not yet insured with NTUC Income will receive a S$50 discount off their first year premiums if they decide to sign up for Enhanced IncomeShield."[Rewards await healthy NTUC Income clients (TDY, 28May2015)]

For one thing, I believe that medishield-life premiums are probably going to increase exponentially no matter how much 'prefunding' premised deductions are made from individual CPF medisave accounts if there is no policy effort at promoting/ rewarding healthy lifestyle adoption amongst (compulsory) insurance policy holders.

The future average national medishield-life healthcare insurance policyholder if healthy-lifestyles is not promoted/ encouraged:

pict source: http://joeforamerica.com/2014/12/fat...w-disability/#

pict source: http://joeforamerica.com/2014/12/fat...w-disability/#

In anycase, chronic-disease and absenteeism is already catching up with the average Singaporean: 'A new dialysis patient every 5 hours in S'pore' [ST, May 10 2015]

PS: For those suffering from genetic diseases so severe that they might die before chronic disease sets in, government should pay their medishield-life premiums if they are minors or if income low. Those with genetic diseases causing health markers to go awry (e.g. Type one diabetes etc), some proximate marker of fitness or adherence to treatment would qualify such a person for premium discount. For those already plagued by chronic disease (hypertensive, high-cholesterol, diabetic etc): up to 50% discount as compared to a healthy person (pass annual health screen with flying colours) if treatment adherence is maintained.

References:

In regard of the early adoption of a healthy lifestyle, it has since been proven that 'Healthy Lifestyle May Prevent 86% Of Heart Attacks' [Åkesson, A et al 'Low-risk diet and lifestyle habits in the primary prevention of myocardial infarction in Men' J Am Coll Cardiol 2014; DOI: 10.1016/j.jacc.2014.06.1190.]

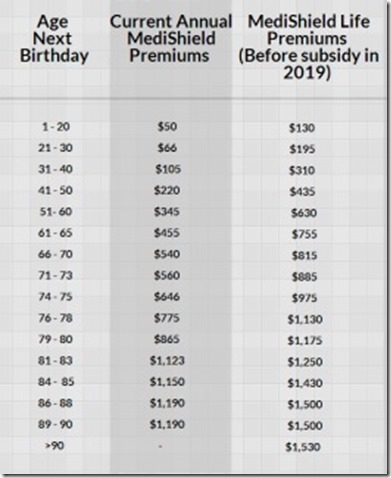

Medishield-life provisional rates:

[source][backup IMG]

[source][backup IMG]

For one thing, I believe that medishield-life premiums are probably going to increase exponentially no matter how much 'prefunding' premised deductions are made from individual CPF medisave accounts if there is no policy effort at promoting/ rewarding healthy lifestyle adoption amongst (compulsory) insurance policy holders.

The future average national medishield-life healthcare insurance policyholder if healthy-lifestyles is not promoted/ encouraged:

pict source: http://joeforamerica.com/2014/12/fat...w-disability/#

pict source: http://joeforamerica.com/2014/12/fat...w-disability/#In anycase, chronic-disease and absenteeism is already catching up with the average Singaporean: 'A new dialysis patient every 5 hours in S'pore' [ST, May 10 2015]

PS: For those suffering from genetic diseases so severe that they might die before chronic disease sets in, government should pay their medishield-life premiums if they are minors or if income low. Those with genetic diseases causing health markers to go awry (e.g. Type one diabetes etc), some proximate marker of fitness or adherence to treatment would qualify such a person for premium discount. For those already plagued by chronic disease (hypertensive, high-cholesterol, diabetic etc): up to 50% discount as compared to a healthy person (pass annual health screen with flying colours) if treatment adherence is maintained.

References:

In regard of the early adoption of a healthy lifestyle, it has since been proven that 'Healthy Lifestyle May Prevent 86% Of Heart Attacks' [Åkesson, A et al 'Low-risk diet and lifestyle habits in the primary prevention of myocardial infarction in Men' J Am Coll Cardiol 2014; DOI: 10.1016/j.jacc.2014.06.1190.]

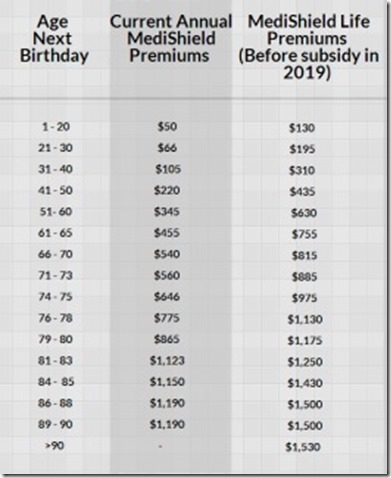

Medishield-life provisional rates:

[source][backup IMG]

[source][backup IMG]

Quote:

| Rewards await healthy NTUC Income clients SINGAPORE – NTUC Income’s insured clients who have been staying healthy are set to enjoy a new rewards scheme, which includes a basic health screening offered at a special rate of S$15 at selected Unity Pharmacy outlets on weekdays. BY LAURA ELIZABETH PHILOMIN - 28 MAY2015 SINGAPORE – NTUC Income’s insured clients who have been staying healthy are set to enjoy a new rewards scheme, which includes a basic health screening offered at a special rate of S$15 at selected Unity Pharmacy outlets on weekdays. The health screenings, which are open to the public at the same rate, is part of NTUC Income’s Orange Health programme which aims to encourage Singaporeans to maintain a healthy lifestyle. Those who pass all four health markers — Body Mass Index, blood pressure, fasting blood glucose and cholesterol — and are currently insured under NTUC Income’s IncomeShield or Enhanced IncomeShield will receive a S$50 CapitaMall shopping voucher each year that they take the test. Singaporeans who are not yet insured with NTUC Income will receive a S$50 discount off their first year premiums if they decide to sign up for Enhanced IncomeShield. Interested participants who are not free on weekdays can also register for health screenings with Healthway Medical at NTUC Income’s branches at Bras Basah, Tampines and Ang Mo Kio on selected Saturdays. Speaking to TODAY at the launch of the Orange Health programme today (May 27), Mr Marcus Chew, senior vice-president of strategic marketing and communications at NTUC Income, said that the rewards scheme was partly a response to public feedback for insurers to provide “good-health” bonus or rebates. Assuring policyholders with poorer health screening results that it will not affect their insurance coverage or premiums, Mr Chew said that the results will not be automatically submitted to NTUC Income, and it will be up to clients to send them in. With more Singaporeans diagnosed with chronic conditions such as obesity, diabetes and hypertension, Unity Pharmacy’s director of pharmacy practice and development Peter Yap said health screenings are useful to detect conditions early to prevent future complications. The screenings will be done with minimal blood draws and participants will receive on-the-spot results. However, health screenings at Healthway Medical will involve a full blood draw and results will be posted three weeks later. Mr Yap said Unity Pharmacy outlets that will offer health screenings between 9am to noon on weekdays are Rivervale Plaza, Ang Mo Kio MRT Station, East Point Mall, Clementi Mall and Tanjong Pagar Plaza. Those interested in the health screening will have to register at least two weeks in advance. They will also have to fast for 12 hours before the test. The first test will be available on June 15. As part of NTUC Income’s programme, the insurance company also introduced a new Orange Health application to allow users to save information on results of their health screening, medical appointments, insurance details and even set medication or supplement reminders for their family members. A check with other insurance companies revealed that Great Eastern has a similar rewards programme, the three-year Live Great Healthy Rewards, where customers with a good health assessment score will receive cash rewards of up to 15 per cent of their policy premiums for the first two years, and 30 per cent of the premiums in the third year. Policyholders who have poorer scores will have their follow-up consultations paid for by the insurance company. Yesterday, AIA also announced that it had partnered with A*STAR’s Institute for Infocomm Research (I2R) to use data analytics to develop programmes and products to help bridge gaps in families’ insurance coverage. According to NTUC Income, its Orange Health app will allow for password protection and the insurer will not be accessing or tracking data stored in it. http://www.todayonline.com/singapore...taying-healthy |

__________________

No comments:

Post a Comment